The FY 2024 IPPS Final Rule, issued by the Centers for Medicare & Medicaid Services (CMS), is crucial for hospitals and insurance providers. This rule sets payment standards for inpatient stays and directly influences Medicare reimbursements, thus impacting hospital revenue significantly.

At BESLER, we want to delve deeper into the nuances of the FY 2024 IPPS Final Rule, elaborating on its implications and offering insights into navigating these alterations successfully.

Understanding how these changes may affect your hospital’s revenue integrity and reimbursement strategy can be challenging, but BESLER is here to help you navigate these complexities.

Reimbursement Updates

A significant focus of the FY 2024 IPPS Final Rule is updates to the reimbursement framework, directly impacting hospitals’ revenue generation.

Base Rate Updates

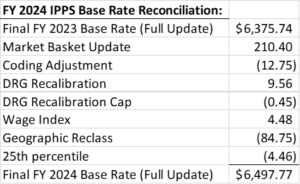

For FY 2024, the finalized IPPS federal rates were increased by the market basket increase of 3.3% and then reduced by a productivity adjustment of 0.2% netting facilities a 3.1% increase in the federal base rate. After application of additional statutory adjustments, the base rate increased from $6,375.74 in FY 2023 to $6,497.77 in FY 2024, a net increase of 1.9%. CMS estimates this increase to equate to an additional $2.2B in hospital payments for FY 2024.

Hospitals are also subject to various other payment adjustments, including those for excessive readmissions, conditions acquired in the hospital, and performance-based adjustments. Furthermore, payments for new medical technologies will see a decrease of $364 million due to the expiration of add-on payments for several technologies.

Wage Index Policy Changes and Updates

For FY 2024, the Wage Index data for hospitals with a section 412.103 reclassification will now be included with the rural area they are reclassified to. In contrast, “Dual” reclassified hospitals are exempt from this provision. If a hospital facility has a “dual reclassified” status, that is a facility with a reclassification under section 412.103 and a reclass from the Medicare Geographic Classification Review Board (MGCRB), their data will remain in the area it is currently being reported.

CMS is continuing the Low Wage Hospital policy for FY 2024. The Low Wage Policy is a temporary policy aimed at addressing wage index disparities affecting low-wage index hospitals, many of them being rural facilities. Facilities in the top quartile having the highest wage indexes can experience up to a 5% reduction from their prior year’s wage index to be redistributed to facilities in the lowest quartile. The Low Wage Hospital Index quartile measurement for FY 2024 is 0.8667.

Disproportionate Share Hospital Updates

For Medicare Disproportionate Hospitals, there are changes to the handling of Demonstration 1115 Waiver Days in the Medicaid Proxy in Factor 1, the amount of the Uncompensated Care Payment Pool in Factor 2, and the inclusion of three years of audited data in the calculation for Factor 3. There is also a change in which types of facilities can qualify and receive the capital DSH add-on payment.

- Factor 1: The traditional Medicare DSH formula includes two calculations, the Medicare Proxy and the Medicaid Proxy. These two calculations are added together and then reduced to 25%. The resulting factor, Factor 1, is then applied to the hospital’s DRG payments to calculate the Factor 1 add-on payment. CMS projected the total add-on payment for Factor 1 for FY 2024 to be $10.02B. The Factor 1 add-on for FY 2023 was projected to be $10.5B. This is an estimated $500M decrease in DSH add-on payments to hospital facilities.

- Factor 2: FY 2024 is being reduced because of a reduction of 40.71% in uncompensated care volume compared to the base level FY 2016. This reduction in the payment pool for Factor 2 is $957M from $6.8B for FY 2023 to $5.9B for FY 2024.

- Factor 3: The FY 2024 calculation will include three years of audited WS S-10 data. FY 2023 included FY 2018 and FY 2019 WS S-10 data. FY 2024 will include data for FY 2018 through FY 2020.

Section 1115 Waiver Days

CMS finalized changes and clarification as to which Section 1115 waiver days can be included in the Medicaid Proxy of the Medicare DSH formula of Factor 1. Section 1115 waiver days that qualify as a Medicaid eligible day are days in which the patient has health insurance that covers inpatient hospital services or receives premium assistance that covers 100% of the premium cost to the patient which the patient uses to purchase insurance that covers inpatient hospital services, and in either case, the patients are not eligible for care under Medicare Part A.

Capital DSH Add-On

CMS has finalized for discharges occurring on or after October 1, 2023, hospitals reclassified as rural under § 412.103 will no longer be considered rural for purposes of determining eligibility for capital DSH payments and will be eligible to receive the additional payments.

Rural Emergency Hospital GMEs

For cost reports beginning on or after October 1, 2023, Rural Emergency Hospitals have been deemed eligible to receive additional payments for Graduate Medical Education (GME). Rural Emergency Hospitals will be treated in a similar manner as Critical Access Hospitals in that they can choose to receive reimbursement for GME at 100% of the facility’s cost.

Coding Updates from FY 2024 IPPS Final Rule

The FY 2024 IPPS Final Rule includes numerous changes to medical coding. These updates improve accuracy for new diseases, medical devices, and technologies and provide more specific classifications for existing conditions.

The FY 2024 IPPS Final Rule includes numerous changes to medical coding. These updates improve accuracy for new diseases, medical devices, and technologies and provide more specific classifications for existing conditions.

ICD-10 CM Changes

The ICD-10-CM update for FY 2024 is relatively small compared to last year’s update; however, some of the changes are significant.

Expansions and Revisions in ICD-10 CM Codes

New codes were added within these updates, emerging medical devices, and refined classifications of existing conditions. Recent revisions will improve coding accuracy and consistency and include 395 new codes, 25 deleted codes and 13 revised codes.

CMS has continued to add specificity. Coders can see significant changes in cerebrovascular accident entries, arteriosclerosis with infarction entries additions, the main index entry for Cachexia was changed, new codes for benign neoplasm of other ill-defined parts of digestive system were added, Parkinson’s disease codes were expanded, multiple new codes that include coronary microvascular dysfunction/disease were added and include a new code for MINOCA, and Osteoporosis codes (all types) were expanded to accommodate more sites.

The Impact of ICD-10 CM Changes

Hospitals must update their coding systems and train their staff to adjust to these revisions. They must also closely collaborate with payers to ensure they process claims correctly under the new codes.

Severity Level Designation: 3 ICD-10 Z Codes

The FY 2024 IPPS Final Rule introduces three new ICD-10 Z codes, addressing homelessness from various perspectives. These codes, Z59.00 (homelessness, unspecified), Z59.01 (sheltered homelessness), and Z59.02 (unsheltered homelessness), designated as complication or comorbidity (CC), recognize the critical link between socioeconomic conditions and health conditions.

Z codes for homelessness, or social determinants of health diagnosis codes for homelessness have changed. For FY 2024, homelessness Z codes will now “CC” or complication or comorbidity. CMS recognizes homelessness as an indicator of increased resource utilization in the acute inpatient hospital setting. If homelessness is documented, reporting Z codes for homelessness unspecified, sheltered homelessness or unsheltered homelessness as secondary diagnosis can result in higher payments to hospitals.

Effective Utilization of New ICD-10 Z Codes

Hospitals must equip themselves with the knowledge and capability to utilize these new ICD-10 Z codes effectively to ensure accurate reporting and optimal reimbursement, ultimately improving patient care. Incorporating them into coding practices aligns with the broader healthcare industry’s shift toward a more comprehensive care delivery and disease management approach.

Procedure Code Changes

The FY 2024 IPPS Final Rule brings essential changes to procedure codes, matching them with new medical technology and advancements.

New Procedure Codes

The Rule features 78 new procedure codes, including codes for new technologies. These technologies include surgeries and implanted devices. It also includes 5 deleted codes and 14 revised titles.

The FY 2024 IPPS Final Rule also introduces new categories for existing procedures. These additions reflect the evolving medical science atmosphere, necessitating coding system adjustments.

Revisions

The new codes include complicated surgeries. These revisions enhance the coding system’s specificity, refining data quality and reimbursement accuracy.

Deleted Procedure Codes

The Final Rule excludes codes that are no longer needed or accurate. These codes include those for old medical procedures, procedures now classified differently, and recently deemed outpatient procedures. The deletions declutter the coding system and mitigate the risk of inaccuracies.

Effects of Procedure Code Changes

Hospitals must update coding systems, train staff, and work with payers to process claims correctly. Appropriately adapting to these changes is essential for seamless operations under the FY 2024 IPPS Final Rule. Hospitals must ensure that their healthcare professionals know about these changes to avoid problems with care.

MS-DRG System Changes

The FY 2024 IPPS Final Rule introduces significant alterations to the Medicare Severity-Diagnosis Related Group (MS-DRG) system, impacting inpatient hospital billing practices. The updates aim to enhance the system’s precision in reflecting the complexity and cost of treating various severe conditions.

There are exciting changes to our MS-DRGs for 2024. Last year, only weights were revised, but this year, CMS created 15 new MS-DRGs and deleted 16 MS-DRGs. This is because some existing MS-DRGs were expanded to include with CC, with MCC, and without CC/MCC. The majority of MS-DRG changes are in MDC-5, Diseases and Disorders of the Circulatory System. There were several reassignments of MS-DRGs for procedures that make more sense.

These revisions aim to improve the accuracy of the coding system in representing patients’ health statuses and healthcare services.

Implications for Hospitals and the Healthcare Industry

The MS-DRG system changes introduced in the FY 2024 IPPS Final Rule present a considerable challenge for hospitals. Adapting to these changes necessitates updating coding systems and training staff. Staying informed about modifications is essential for hospitals to maintain accurate billing practices and secure proper payments.

How Reimbursement & Coding Teams Can Prepare

Hospitals and healthcare providers must understand the extensive changes introduced by the FY 2024 IPPS Final Rule. The initial step involves carefully reviewing the Final Rule, focusing on understanding the new, revised and deleted ICD-10 CM codes, procedure codes, and MS-DRGs.

Hospitals and healthcare providers must understand the extensive changes introduced by the FY 2024 IPPS Final Rule. The initial step involves carefully reviewing the Final Rule, focusing on understanding the new, revised and deleted ICD-10 CM codes, procedure codes, and MS-DRGs.

System and Material Updates for Compliance

Hospitals must undertake comprehensive system and material updates to align with the latest guidelines. Alter health records, upgrade billing software, and modify documentation to abide by the newly established coding standards.

Testing and Communication for Seamless Transition

Validating the accuracy of new and revised codes through testing is a proactive measure. Hospitals can do so by submitting test claims to payers, assuring precision, and mitigating potential errors in the reimbursement process.

Maintaining open lines of communication with payers is essential. Informing them about the awareness of the new codes and MS-DRGs facilitates smoother transitions, reducing the risk of delays in claims processing.

Staff Education and Training

Focusing on staff education and training is vital. Regular training sessions on the new codes and MS-DRGs enable staff to adapt quickly. A well-informed team is less likely to make errors that could result in claim denials or delays, ensuring efficient implementation of the changes.

Establishing a Monitoring and Auditing Plan

To ensure successful implementation of the FY 2024 IPPS Final Rule updates, hospitals should develop and implement a comprehensive plan for monitoring and auditing coding processes to identify and correct errors. Collaborating closely with healthcare professionals to ensure accurate and complete coding and billing processes is essential.

Initiate these steps early and maintain organizational readiness, taking a proactive approach throughout the implementation process.

BESLER is Here to Help

Navigating the changes introduced by the FY 2024 IPPS Final Rule can be daunting, but you are not alone. BESLER’s team of experts is here to help hospitals stay compliant and ensure they receive the revenue they’ve earned. Our proficiency in healthcare reimbursement and proven track record in revenue integrity make us an ideal partner in this journey.

Navigating the changes introduced by the FY 2024 IPPS Final Rule can be daunting, but you are not alone. BESLER’s team of experts is here to help hospitals stay compliant and ensure they receive the revenue they’ve earned. Our proficiency in healthcare reimbursement and proven track record in revenue integrity make us an ideal partner in this journey.

Stay ahead of the curve by harnessing the insights and knowledge BESLER offers. We seek to empower hospitals and healthcare providers to thrive in the evolving healthcare reimbursement landscape. With BESLER, you can trust that you will keep pace with the FY 2024 IPPS Final Rule and beyond.

For additional information, visit the IPPS Final Rule page on the CMS website.