This post contains key changes to the IPPS Final Rule 2021. If you require assistance or have questions about your hospital’s Medicare reimbursement, BESLER’s reimbursement team can help.

If you have any questions, please contact Jeff Wolf: jwolf@besler.com or (609) 445-2203.

For this content plus additional charts and information:

at the end of this presentation

at the end of this presentation

Listen to BESLER’s Jimmy Mendez provide analysis on the 2021 IPPS Final Rule

Listen to BESLER’s Jimmy Mendez provide analysis on the 2021 IPPS Final Rule

Rates and Spending

The Market Basket Rate increase for the upcoming federal fiscal year is 2.4%. That is the maximum a hospital provider can receive. It is adjusted downward based on whether or not the hospital submitted Quality Data and whether or not the hospital is a meaningful user.

Medicare DSH

The estimated Medicare DSH amount for FY 2021 is $15,170,673,476 (25% of which pertains to Empirical DSH).

Uncompensated Care Payments

Uncompensated Care is comprised of three factors:

- Estimated Medicare DSH

- CMS’ uninsured estimate

- UC payment calculation

Factor 1 is the estimated Medicare DSH amount for FY 2021 of $15.170 Billion less the 25% for Empirical DSH. The result is $11,378,005,107 for Factor 1.

Factor 2 is the uninsured estimate produced by CMS’ Office of the Actuary (OACT). The Proposed Rule originally had 67.86%; however, the Final Rule will use a more recent estimate that takes into consideration the effects of COVID-19. That figure is 72.86% and its application results in a total Uncompensated Care budget of $8,290,014,520 ($11,378,005,107 x 72.86%) which is down slightly from the $8.4 billion in FY 2020.

Factor 3 determines what portion of the pie a hospital will receive in UC payments. For FY 2021, Factor 3 will be calculated using Line 30 of Worksheet S-10 from 2017 cost report data. This is the most recent available single year audited S-10 data.

For Future Years: CMS will use the most recent available single year audited S-10 data.

Wage Index

Based on revised OMB delineations, 34 counties designated as Urban would become Rural effective beginning with the FY 2021 wage index; 47 counties that were previously Rural will now be considered Urban; and 19 counties would move to another CBSA or to a new or modified CBSA.

There is a 5 percent cap on any decrease in a hospital’s wage index from the hospital’s final wage index in FY 2020.

The FY 2021 wage index values are based on the data collected from the Medicare cost reports submitted by hospitals for cost reporting periods beginning in FY 2017 (beginning on or after 10/1/16 and before 10/1/17). The 2016 Medicare Wage Index Occupational Mix Survey is applicable for the FY 2021 wage index.

Low wage index hospitals

Hospitals with a wage index value below the 25th percentile will continue to have their wage index value increased by half the difference between the final wage index for that hospital and the 25th percentile across all hospitals.

The 25th percentile for FY 2021 is estimated to be 0.8420.

Rural floor

The area wage index applicable to any hospital that is located in an urban area of a State may not be less than the area wage index applicable to hospitals located in rural areas in that State, which Is estimated to benefit 285 hospitals In FY 2021.

The rural floor for this FY 2021 final rule is calculated without the wage data of hospitals that have reclassified as rural under § 412.103.

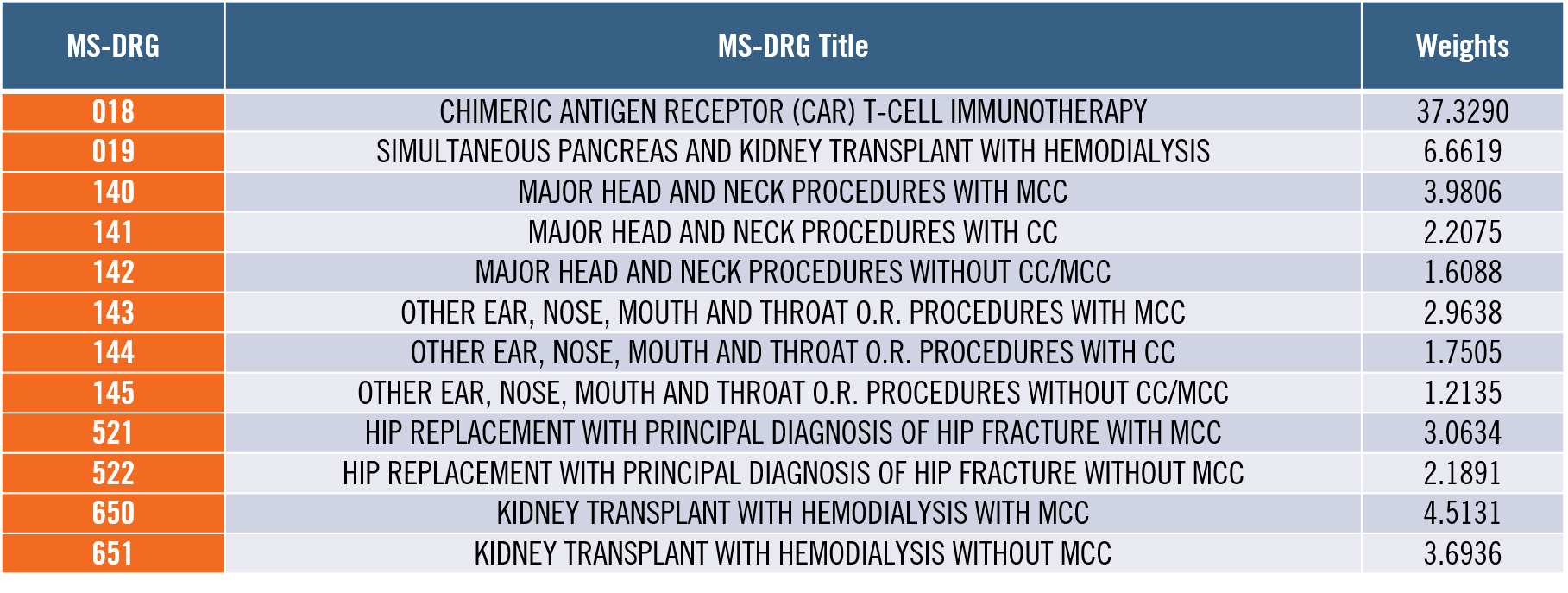

New MS-DRGs

There are 12 new MS-DRGs for FFY 2021:

MS-DRG 018 is of particular interest due to its very high DRG Weight.

In addition, MS-DRGs 129 and 130 will be deleted.

Stem Cell Acquisition Costs

Effective for cost reporting periods beginning on or after October 1, 2020, costs related to hematopoietic stem cell acquisition for the purpose of an allogeneic hematopoietic stem cell transplant will be reimbursed on a reasonable cost basis.

A hospital that furnishes an allogeneic hematopoietic stem cell transplant is not required to be a Medicare certified transplant center as is required for solid organs; therefore, a hospital that bills using revenue code 0815 for inpatient allogeneic hematopoietic stem cells is sufficient verification.

New Technology Add-On Payments

CMS will establish a process in which certain antimicrobial products approved as QIDPs (Qualified Infectious Disease Products), approved under an alternative inpatient new technology add-on payment pathway, would receive conditional approval for a payment even if the product has not been granted FDA marketing authorization by July 1, but otherwise meets the applicable add-on payment criteria.

This appears directly correlated with the COVID-19 pandemic.

Price Transparency

Hospitals will report on their Medicare cost report the median payer-specific negotiated charge that the hospital has negotiated with all of its Medicare Advantage (MA) organization payers, by MS-DRG, for cost reporting periods ending on or after January 1, 2021.

In addition, CMS Is finalizing the adoption of a market-based MS-DRG relative weight methodology for calculating the MS-DRG relative weights, beginning in FY 2024. The market-based MS-DRG relative weight methodology would utilize the median payer-specific negotiated charge data negotiated between hospitals and MA organizations.

Hospital Acquired Conditions Reduction Program

HAC Reduction Program currently evaluates participating hospitals through six measurements: one CMS patient safety and adverse events measure and five CDC health care-associated infections measures. Since 2019, CMS has used a 24-month period to collect sets of measurements. This 24-month period methodology will become permanent and will advance by one year automatically thereafter every year.

Hospital Readmissions Reduction Program

The Hospital Readmission Reduction Program reduces payments to hospitals based on readmission rates. Traditionally, CMS has used three years of data for measuring readmissions, and the applicable period is announced with each rulemaking. CMS is making permanent the three-year reporting period of readmission data for the Hospital Readmissions Reduction Program. The measures created in FY 2019 will remain unchanged. This program is expected to save CMS over $500 million and impact over 2,000 hospitals.

Hospital Value Based Purchasing Program

CMS is providing newly established performance standards for certain measures for the FY 2023 program year, the FY 2024 program year, the FY 2025 program year, and the FY 2026 program year. the estimated amount available for value-based incentive payments for FY 2021 discharges is approximately $1.9 billion.

Hospital Inpatient Quality Reporting

Hospitals are required to report data on measures selected by the Secretary for a fiscal year in order to receive the full annual percentage increase that would otherwise apply to the standardized amount applicable to discharges occurring in that fiscal year. CMS has finalized proposals to the reporting, submission, and public display requirements of the data (eCQM) to include the increase of the number of quarters of data being reported.

Medicare Bad Debt

The requirements for a Medicare Bad Debt are in 42 CFR 413.89 and in the PRM Chapter 3. The PRM Chapter 3 is more specific concerning the requirements and has been applied by most MACs. It appears the main objective by CMS is to codify these longstanding applications. Documentation required includes Bad Debt Collection Policy, Patient Account history that documents collection efforts, and indigence determination policy.

Medicare Bad Debt Key Requirements

Efforts to collect the Medicare deductible and coinsurance must be similar to the effort the provider puts forth to collect comparable amounts from non-Medicare patients. Reasonable collection efforts for non-indigent beneficiaries must last at least 120 days; and must start anew each time a payment is received.

A bill must be issued on or before 120 days after the latter of one of the following:

- The date of the Medicare remittance advice that is produced from processing the claim for services furnished to the beneficiary that generates the beneficiary’s cost sharing amounts

- The date of the remittance advice from the beneficiary’s secondary payer, if any

- The date of the notification that the beneficiary’s secondary payer does not cover the service(s) furnished to the beneficiary

In order to conclude that a non-dual eligible beneficiary is indigent, the provider:

- Must not use a beneficiary’s declaration of their inability to pay their medical bills or deductibles and coinsurance amounts as sole proof of indigence or medical indigence

- Must take into account the analysis of both the beneficiary’s assets (only those convertible to cash and unnecessary for the beneficiary’s daily living) and income

- May consider extenuating circumstances that would affect the determination of the beneficiary’s indigence or medical indigence which may include an analysis of both the beneficiary’s liabilities and expenses

- Must determine that no source other than the beneficiary would be legally responsible for the beneficiary’s medical bill, such as a legal guardian or State Medicaid program

Dual eligible accounts – The provider must bill the state and submit the resulting Medicaid RA to Medicare and deduct the appropriate state cost sharing liability from the Medicare bad debt reimbursement

Financial reporting – For cost reporting periods before October 1, 2020, Medicare bad debts must not be written off to a contractual allowance account but must be charged to an expense account for uncollectible accounts.

For cost reporting periods on or after October 1, 2020, Medicare bad debts must not be written off to a contractual allowance account but must be charged to an uncollectible receivables account that results in a reduction in revenue